Mumbai: A Central Bureau of Investigation (CBI) probe into transactions between Yes Bank and the Anil Ambani-led Reliance Group of companies revealed a complex web of fund diversions and misuse of commercial papers (CPs) through a network of shell entities, documents accessed by ET show.

The findings, part of a chargesheet filed by the CBI at a special court last month, allege that the transactions were part of a criminal conspiracy between former Yes Bank CEO Rana Kapoor and industrialist Anil Ambani, which caused substantial losses to the private lender. The Enforcement Directorate (ED) is conducting a parallel probe into the alleged irregularities. These pertain to transactions that took place when Yes Bank was led by Kapoor. Yes Bank's management has changed since then following a rescue orchestrated by the Reserve Bank of India. Kapoor, facing money laundering and other charges, is currently out on bail.

An email sent to the Anil Dhirubhai Ambani Group (ADAG) seeking comment did not get a response. In the past, the group has denied all allegations of wrongdoing.

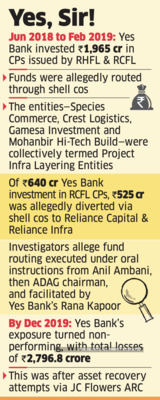

According to the CBI's findings, between June 2018 and February 2019, Yes Bank subscribed to CPs worth ₹1,965 crore issued by Reliance Home Finance Ltd (RHFL). While most of this was repaid, a tranche of ₹360 crore invested in September 2018 turned contentious. Around the same period, Reliance Commercial Finance Ltd (RCFL) raised ₹640 crore from Yes Bank through CPs.

According to the CBI's findings, between June 2018 and February 2019, Yes Bank subscribed to CPs worth ₹1,965 crore issued by Reliance Home Finance Ltd (RHFL). While most of this was repaid, a tranche of ₹360 crore invested in September 2018 turned contentious. Around the same period, Reliance Commercial Finance Ltd (RCFL) raised ₹640 crore from Yes Bank through CPs.

"The purpose of creating this shell company was to receive money from RHFL and RCFL and further transfer the same to other ADAG companies for discharging their liabilities," the court document states.

For instance, on September 17, 2018, RHFL received a CP investment of ₹327 crore and used ₹150 crore to repay UTI Liquid Fund and ₹200 crore to extend a loan to Gamesa Investment Management Pvt Ltd-a company with a paid-up capital of just ₹1 lakh and no active business operations.

"The said company was not eligible for receiving a high loan amount of ₹200 crore. This loan was sanctioned on instructions of Anil Ambani because the borrower company was a shell entity operated by employees of ADAG companies," the document states. Gamesa Investment Management then transferred the entire ₹200 crore to Reliance Capital, showing it as an inter-corporate deposit.

A similar pattern was observed in the case of RCFL. Of the ₹640 crore raised through Yes Bank's CP investment on September 19, 2018, RCFL allegedly diverted ₹525 crore through a series of entities identified as Project Infrastructure Layering Entities (PILEs)-namely Species Commerce and Trade Pvt Ltd, Crest Logistics and Engineers Pvt Ltd, Gamesa Investment Management, and Mohanbir Hi-Tech Build Pvt Ltd-all linked to the ADAG.

On the same day as Yes Bank's investment, ₹125 crore was transferred by RCFL to Species Commerce, which immediately passed it on to Crest Logistics, and from there to Reliance Infrastructure Ltd, which used the funds to pay dividends to shareholders - a diversion from their intended purpose.

The findings, part of a chargesheet filed by the CBI at a special court last month, allege that the transactions were part of a criminal conspiracy between former Yes Bank CEO Rana Kapoor and industrialist Anil Ambani, which caused substantial losses to the private lender. The Enforcement Directorate (ED) is conducting a parallel probe into the alleged irregularities. These pertain to transactions that took place when Yes Bank was led by Kapoor. Yes Bank's management has changed since then following a rescue orchestrated by the Reserve Bank of India. Kapoor, facing money laundering and other charges, is currently out on bail.

An email sent to the Anil Dhirubhai Ambani Group (ADAG) seeking comment did not get a response. In the past, the group has denied all allegations of wrongdoing.

"The purpose of creating this shell company was to receive money from RHFL and RCFL and further transfer the same to other ADAG companies for discharging their liabilities," the court document states.

For instance, on September 17, 2018, RHFL received a CP investment of ₹327 crore and used ₹150 crore to repay UTI Liquid Fund and ₹200 crore to extend a loan to Gamesa Investment Management Pvt Ltd-a company with a paid-up capital of just ₹1 lakh and no active business operations.

"The said company was not eligible for receiving a high loan amount of ₹200 crore. This loan was sanctioned on instructions of Anil Ambani because the borrower company was a shell entity operated by employees of ADAG companies," the document states. Gamesa Investment Management then transferred the entire ₹200 crore to Reliance Capital, showing it as an inter-corporate deposit.

A similar pattern was observed in the case of RCFL. Of the ₹640 crore raised through Yes Bank's CP investment on September 19, 2018, RCFL allegedly diverted ₹525 crore through a series of entities identified as Project Infrastructure Layering Entities (PILEs)-namely Species Commerce and Trade Pvt Ltd, Crest Logistics and Engineers Pvt Ltd, Gamesa Investment Management, and Mohanbir Hi-Tech Build Pvt Ltd-all linked to the ADAG.

On the same day as Yes Bank's investment, ₹125 crore was transferred by RCFL to Species Commerce, which immediately passed it on to Crest Logistics, and from there to Reliance Infrastructure Ltd, which used the funds to pay dividends to shareholders - a diversion from their intended purpose.

You may also like

Top doctor reveals why Trump suddenly got an MRI scan: 'Undisclosed medical problems...'

Grigor Dimitrov makes triumphant comeback 112 days after quitting Wimbledon match in tears

'Perfectly cast' Marvel movie with top rating finally confirms free streaming date

UK to spend £150m on underwater drones as Russia tensions mount

'Underrated' TV shows hailed 'one of the funniest' - but fans say 'Netflix ruined it'