By early 2021, India’s online grocery market had reached an inflexion point. The initial challenge, persuading consumers to buy from e-marketplaces for convenience, was largely over. Same-day delivery was fast becoming an industry benchmark. And the race was shifting to the next battleground: Speed. A handful of ambitious players were gearing up to offer ‘instant’ doorstep delivery.

The concept was not exactly novel. Ultra-fast delivery had its first run in the US, Europe and parts of Asia in the late 1990s and early 2000s. Early players like Delivery Hero, Deliveroo, Uber Eats and Just Eat built their empires on restaurant deliveries, much like Zomato in India. But GoPuff stood out, extending the model to snacks, household goods and other essentials.

Today’s quick-commerce (q-commerce) landscape has evolved into something broader. One can get printed documents or passport photos home-delivered within 15 minutes. The sector is growing, but not at the breakneck pace of traditional ecommerce. Globally, q-commerce is projected to reach $337.6 Bn by 2032, up from $184.5 Bn in 2025, at a CAGR of 9.01%. On the other hand, ecommerce is on track to hit $75.1 Tn by 2034, from $21.6 Tn in 2025, growing at a 14.9% CAGR.

The story is still unfolding in India, but venture capital has been the most persistent visitor to the ecommerce space. VCs poured in $35 Bn+ since 2014 as founders and investors chase the promise of high-frequency, habit-forming transactions.

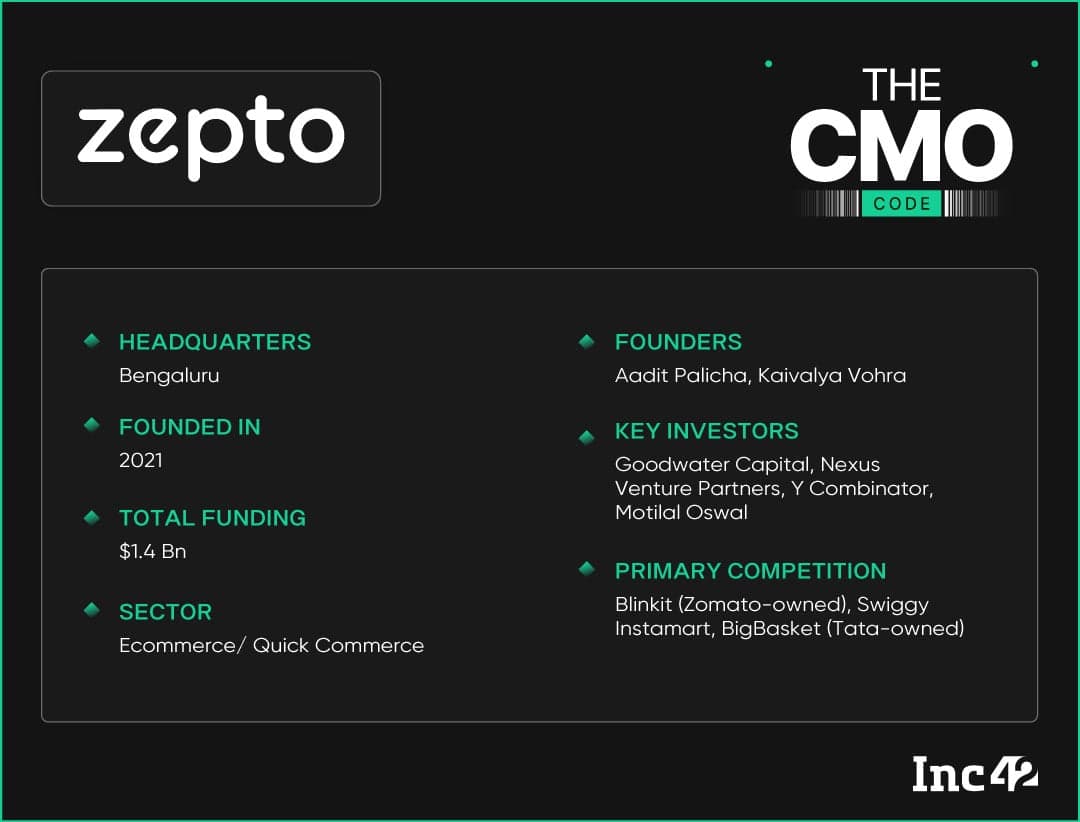

Nevertheless, when Aadit Palicha and Kaivalya Vohra, computer science students at Stanford, decided to drop out and set up Zepto, the industry was startled by their signature pitch: Groceries delivered in 10 minutes.

The first iteration was KiranaKart, launched in mid-2020 with a 45-minute delivery window using local kirana stores. But within months, the founders pivoted to a dark-store model and a tightly controlled logistics network, confident that their density and operational precision could make the 10-minute promise viable at scale.

In April 2021, a rebranded Zepto launched in Mumbai, its 10-minute pledge supported by a fast-expanding grid of micro-warehouses. These urban fulfilment hubs were designed to compress order processing and last-mile deliveries into a single operational sprint, the backbone of Zepto’s quick-commerce engine.

It was a bold initiative, but Zepto was not the sole player. Around the same time, Blinkit (still operating as Grofers but on its way to the Zomato stable) began piloting its ultra-fast deliveries in select locations. By mid-2021, the company rolled out the 10-minute model across multiple cities, backed by its deep capital base, broader geographic footprint and an evolving logistics stack capable of compressing delivery times without collapsing unit economics.

When Swiggy rolled out Instamart in late 2020, the promise was brisk but not breathless — groceries at your door in 30-45 minutes. BigBasket, too, dabbled in faster fulfilment with BBNow, shaving delivery time where it could. But its mainstay was scheduled grocery delivery. Dunzo, a veteran of hyperlocal logistics, leaned on pick-ups and small-basket deliveries but had a modest footprint.

Into this crowded, tentative space came Zepto, a q-commerce startup built for speed from Day 1. While its rivals inched toward shorter turnaround times, it committed to ultra-fast delivery as a non-negotiable. Zepto optimised every link in the chain, from choosing dark-store sites to SKU curation and fleet management, to make low delivery time the default, not the exception.

Its early marketing matched this single-minded focus. Zepto did not sell the idea of fast groceries as a luxury meant for consumer indulgence. It framed the concept as a lifeline to deal with everyday emergencies. Its ads featured the messy urgency of real life — milk threatening to boil over, but the rest of the ingredients are missing, or a baby urgently needing a diaper change. The message was clear. Sometimes, waiting is not an option.

Back then, many were still sceptical about 10-minute deliveries, wondering if it was a gimmick or a costly race to the bottom due to zero sustainability. But the value became clear as deliveries rolled in and users experienced the convenience firsthand.

“Earlier, people might have said, ‘We will get it in the evening’ or ‘We will buy it tomorrow.’ But over time, they saw how useful immediate delivery could be,” said Chandan Mendiratta, Zepto’s chief brand and culture officer.

As demand surged, rivals quickly shifted gears. Blinkit, Swiggy Instamart and others ramped up their infrastructure to match the 10-minute benchmark. What began as a bold bet on consumer impatience had quietly reset expectations and industry standards, turning ‘tomorrow’ into an anachronism.

It has kick-started a retail category that continues to redefine how urban India shops for groceries, essentials, and increasingly, non-essentials. In fact, it reflects a deeper shift — the transformation of online grocery from a convenience-driven service to an infrastructure-heavy, capital-intensive logistics business — one where margins are thin. But the prize is dominance in a habit-forming category.

Interestingly, Zepto has posted the fastest growth among India’s quick-commerce operators. The startup has scaled to more than 60K SKUs within four years across 25 main categories and 40-50 sub-categories. It runs 900+ dark stores in more than 70 cities, mostly metros and Tier I markets.

“Whatever categories we enter, our core proposition stays. If you look at our tagline, it says: ,” said Mendiratta.

Zepto is now looking to extend that promise in a sector where competitors invest heavily to capture market share. The startup relies on in-house marketing tools, high-frequency brand campaigns, and meticulously managed user acquisition and retention systems to stay ahead of the curve.

As part of our ongoing CMO Code series, Inc42 explores how Zepto positions itself as a long-term player in an industry where scaling profitably is as critical as delivering fast.

According to Mendiratta, “A brand is not just about looking good. It is about staying consistent, showing up often and giving people something worth discussing.”

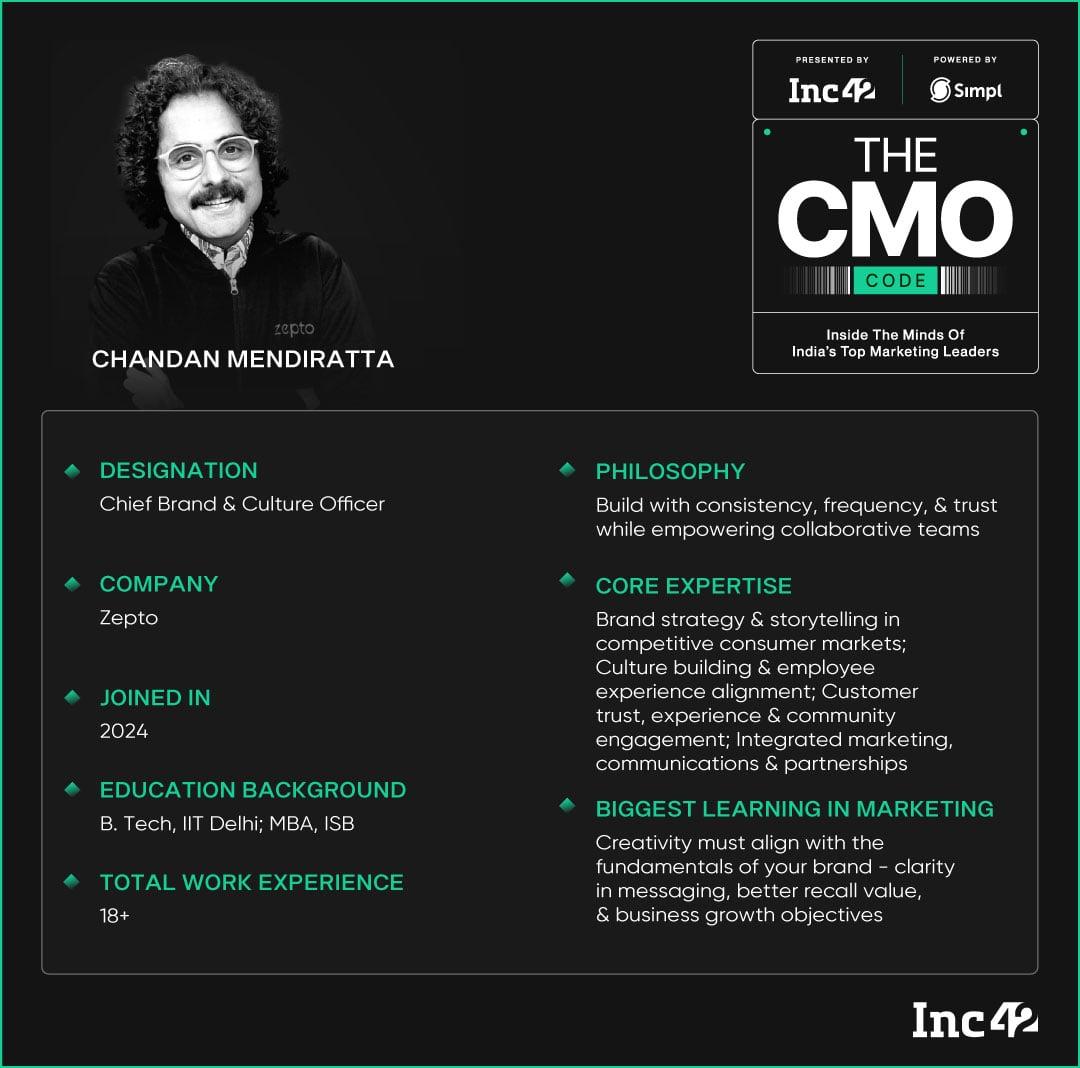

An IIT Delhi alumnus and an MBA from the Indian School of Business, Mendiratta inherited a blank canvas when he joined Zepto in January 2024. There was no brand playbook, no definitive brand voice, just the latitude and the freedom to build it from the ground up.

Consistency Defines Zepto’s Brand VoiceOver time, he developed and crystallised it into a three-part marketing framework anchored on three core pillars — consistency, frequency and earned media.

Quick commerce moves fast, but Zepto’s marketing playbook goes well beyond its speed quotient. The startup has created a well-aligned and well-managed branding system designed to scale across markets, campaigns and partnerships, without spending heavily on traditional advertising.

The first step is visual discipline and guardrails. The team has codified every design detail, from finalising a hex code for Zepto’s signature shade of purple to the font and even the precise kerning (the space between two alphabets). Now, every creative asset passes through a strict set of design rules and cannot deviate from those specifications.

Brand personality or brand voice was also set up early, anchored in a hybrid archetype. It was part hero and part magician, with a dash of the jester. The blend was deliberate, a combination of trust and gravitas, leavened with a sense of playfulness to emanate a respectful yet humorous tone.

Leveraging F requency And Relevance“We didn’t want to go full humour and become crass. Every creative has to balance stature with lightness. That’s where the emotional connection happens,” explained Mendiratta.

In a retail category where consumers may place multiple orders a day, frequency of engagement is just as critical as the brand’s voice. Zepto’s marketers sought to insert the brand into every relevant moment, from major festivals and cultural events to everyday triggers.

For instance, when Mendiratta joined Zepto in mid-January, one of the earliest projects the team created was an unconventional Valentine’s Day campaign. Instead of a standard promotion, they designed a board game called X’s and Ladders. The game was sent out as a card with customer orders, in collaboration with Hershey’s Kisses.

“We made them play X’s and Ladders with Hershey’s chocolates. I was very clear that we had to celebrate every festival because we had to be the most frequent,” said Mendiratta.

Frequency, he explained, was central to Zepto’s positioning. Unlike most businesses that might serve customers once a week or even less often, Zepto operated in a high-touch category.

“In the morning, you could need doodh and bread. In the afternoon, maybe a coffee or a snack. In the evening, it might be stationery, a toy, or jewellery for a night out. Later, you could need ingredients for dinner, or late at night, just snacks. We’re not just everyday—we’re a four or five times a day category,” he said.

To build that kind of regular engagement, Mendiratta and his team focused on push notifications as the next step, making them more interactive and conversational so Zepto could establish a direct line with its customers.

Another example was a December campaign involving Google Pay, built around a ‘2025 box’ and themed on an effortless, joy-filled life powered by the payments platform. The integration carried Google Pay’s branding, with Zepto aligning its storytelling to the partner’s vision.

Earned Media For Deeper Customer BondingFor Zepto, this is a deliberate growth lever. From Gudi Padwa celebrations to Ganesh Chaturthi décor, every kit it designs taps into relevance and emotional resonance, encouraging customers to engage, post and talk about Zepto.

This is building brand salience without paid amplification. Even Zepto Café’s sugar sachets carry playful lines like ‘Warning: Not sweeter than you.’

This approach has created organic sharing and viral spikes, like a Raksha Bandhan campaign featuring customised envelopes (lifaafas). Users shared photos of these envelopes across private WhatsApp groups, and the brand saw a noticeable spike in engagement that week.

Mendiratta said the lift in engagement was clear that week, even if the direct ROI was difficult to isolate and measure. “Was the campaign solely responsible for the traction? Hard to say, but its impact lingered,” he added.

Over time, these cultural cues and cadence have shaped customer expectations. “Our users now anticipate something festive every time a holiday comes around,” he said. “For Zepto, this approach is fundamental. Every creative, activation or message is assessed through a simple lens: Will it make people talk about us? That is where real brand traction begins.”

Further, Zepto has deepened its narrative and reach through collaborations with market leaders and partner brands across categories, from Surf Excel to Eveready to Eno. Between September 2024 to February 2025, Zepto has produced 50-60 brand films, and 99% of these are co-created with partners. Costs have been shared, with the focus on better distribution and in-app engagement.

“What we are building is not just a marketing layer, but a shared story with our partners. When they grow, we grow,” said Mendiratta.

The budget structure also reflects its performance-driven mindset. A rolling six-month budget, managed in sync with the finance team, keeps marketing spend tightly aligned with business targets. Around 80-90% of this amount is meant to improve growth metrics such as bringing in new users, account reactivation and increasing the order frequency of active customers. These top and bottom funnels are meticulously targeted, as the impact is measurable here and the spend can be tracked and justified.

“People think we spend a lot of money on brand marketing because we do so many films. But we operate on a shoestring budget. Influencer campaigns are rare, and brand marketing budgets are kept minimal and strategic,” according to Mendiratta.

Zepto’s performance marketing, creative testing, customer retention, and seasonal narratives are woven into a single playbook—one that balances immediate growth metrics with the longer-term goal of brand salience.

Tools like Zepto Cash help drive re-engagement, while a quarterly Brand Health Tracker captures city-level sentiment by mapping barriers, drivers, top-of-mind recall, and overall awareness. This tracker becomes the go-to document for brand planning. At the same time, the team constantly iterates on creatives and rolls out seasonal campaigns to sustain cultural presence, blending data-backed execution with a more intuitive understanding of consumers.

“It’s actually very difficult to build a framework for performance versus brand. Measurement is the issue — it’s easy to measure a performance campaign, but very hard to measure a brand campaign,” said Mendiratta.

He explained that at Zepto, every creative is first tested within the performance mix, where the system determines how much budget to allocate. Pure reach-and-frequency campaigns, where spends are fixed regardless of outcomes, are rare.

Instead, each creative must hit benchmarks such as CTR, CAC, or cost per order to scale. The exception comes during festivals, when small brand budgets are reserved for occasions like Diwali or Holi. These moments, Mendiratta noted, are about cultural presence as much as performance, and while their impact cannot always be measured, consumption typically rises during such times.

Zepto’s marketing playbook is built less on perfection and more on perception. It has been built around speed, cultural alignment and ruthless iteration to avoid future mistakes. “We don’t get it right every time, but we listen when we don’t,” said Mendiratta. That listening is less about surveys and more about mining the internet chatter, reading the room, tracking the comment subtext and owning the most relevant moments before they pass.

One would say that the brand’s best work often starts in comment sections, on meme trends, or leaning into internet humour to understand consumer sentiment in real time and turn it into revenue-driving creative in hours. They didn’t just go viral, but also impacted business outcomes.

The now-iconic soan papdi campaign is a case in point. Rather than pushing back against the annual diwali gag about regifting sweets, Zepto embraced it, casting the mithai as the bullied yet secretly beloved underdog. The narrative reversal turned a meme into a sales driver, making it the top-selling sweet on the platform.

As Zepto turned four, it partnered with Hershey India to set up an interactive OOH campaign in Mumbai’s Bandra district. It was a chocolate-filled billboard. As people pulled Hershey’s Kisses from the giant display, a hidden birthday message was gradually revealed, turning it into a real-time branding moment.

The idea came from Hershey’s, but the execution was done jointly. The co-branded spectacle blurred the line between outdoor and experiential marketing, and the participatory moment lived as much on social feeds as on the street.

Not all concepts work, though. A bold Super Saver film featuring a live horse and the tagline — we’re not horsing around — fell flat, mainly because the cultural reference missed the mark, and metrics tanked. Lessons learnt: Cultural resonance beats clever wordplay, and creative indulgence must be grounded in comprehension.

As Mendiratta said, “Sometimes we fall in love with an idea but forget the basics: Will it be understood? Will it build brand recall?”

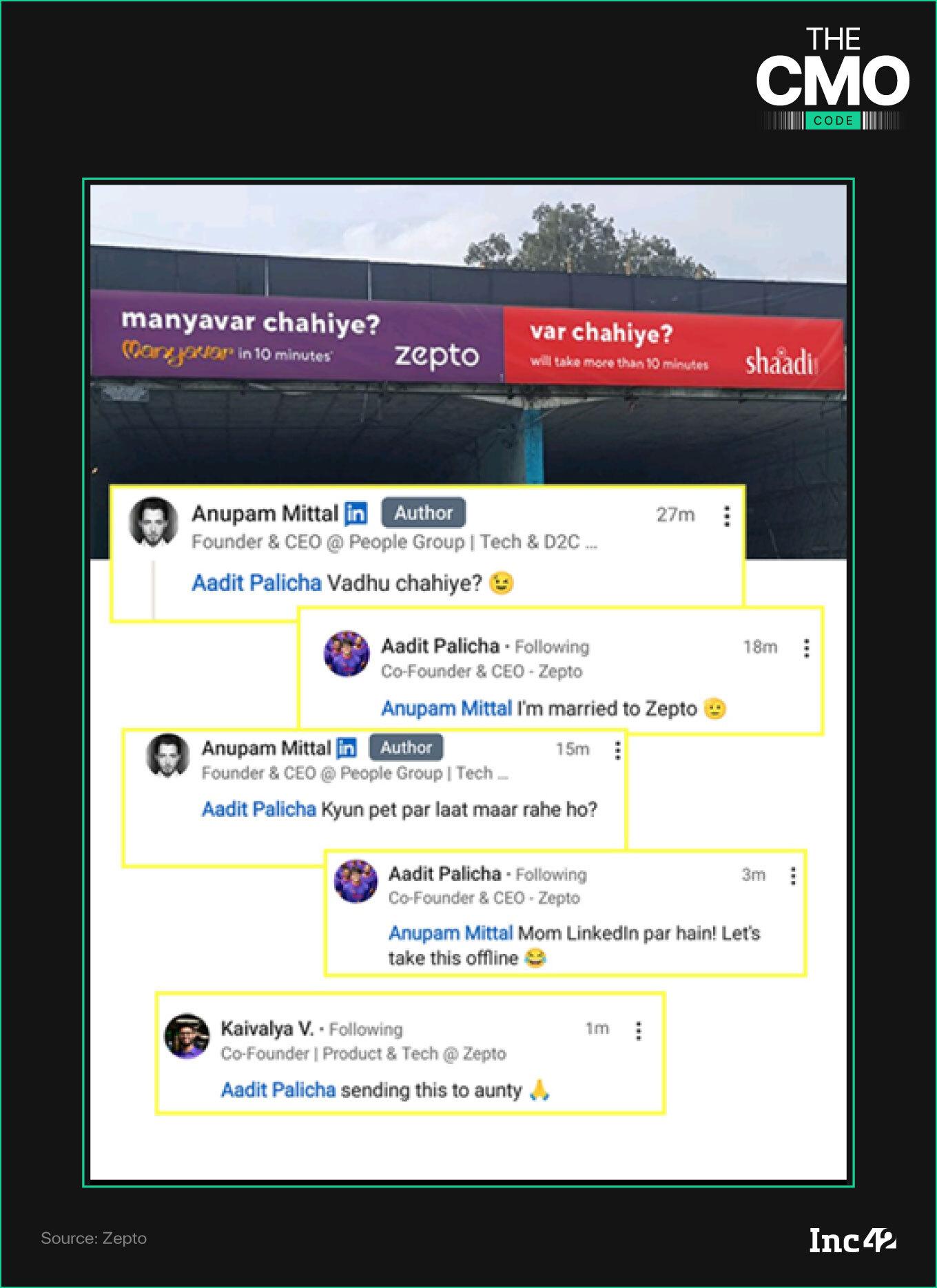

But when things resonate, Zepto moves fast. The brand’s sharpest wins often come from listening closely, like the wedding-themed viral hoarding collaboration with Manyavar, triggered by a user comment on social media. It read: Can you deliver a groom in 10 minutes?

By that evening, Zepto teamed up with Shaadi.com and Manyavar to create a two-part billboard in Mumbai. One read: Manyavar Chahiye? Get Manyavar in 10 minutes with Zepto. Right next to it was Shaadi.com’s cheeky retort: Var Chahiye? This will take more than 10 minutes. Within 24 hours, the campaign went viral, sparking more than 250 brand reactions and creator-led riffs across social media.

“It wasn’t even our idea. It came from a comment. But we listened and executed that same evening,” chuckled Mendiratta.

But behind the apparent playfulness lies a disciplined, performance-first mindset. Every rupee has to drive outcomes in a high-frequency, low-margin delivery business. The film can’t be above the business. The business must come first.

That pragmatism shapes Zepto’s approach to AI, as the brand head is clear-eyed about where the technology fits in and where it does not. That’s why the startup leverages AI tools partially for marketing but only where it directly drives measurable output.

“We have started using AI for our creatives, but only for high-volume, performance-based creatives such as recruitment videos for delivery partners and animations from product stills for more engaging performance ads. But we don’t use AI for brand films. AI is only for performance assets,” the brand head said.

That does not mean Zepto’s competitive edge in marketing lies in human creativity alone. The capability to listen, align and launch in real time also works. It may be the ultimate moat for a retail model where attention cycles can peak and fade in hours.

Brand marketing at Zepto does not work in silos. It is a vibrant nerve centre integrated with the business. The team works in sync with operations for internal branding and delivery partner hiring, collaborates with business units to carry out co-branded initiatives and campaign solutions, and works closely with finance to align marketing spend with performance.

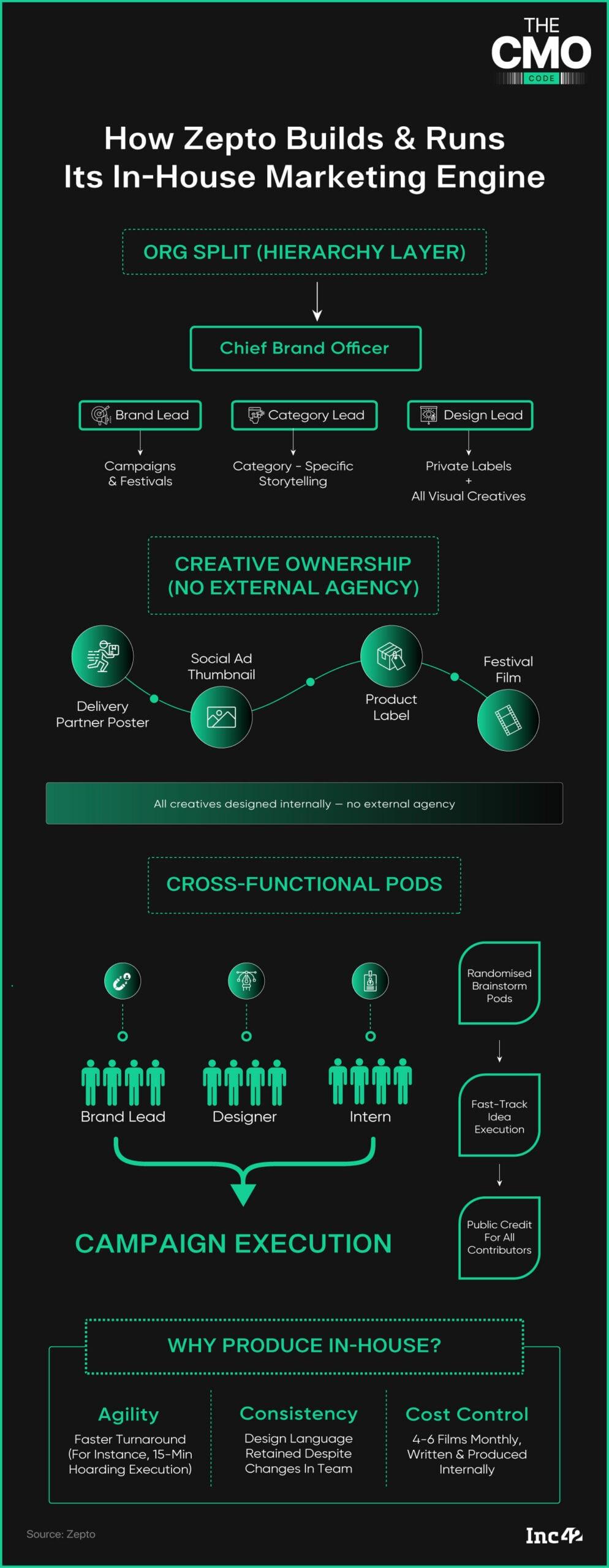

According to Mendiratta, the brand requires a different kind of marketer at this stage. The left-brain archetype, where strategy sits in-house and creativity is outsourced, is giving way to a right-brain, in-house model. Zepto has embraced this shift by building a creative team that writes, produces and executes campaigns end-to-end.

All creatives, from films, static ads and internal branding to acquisition creatives, recruitment assets and private-label packaging, are conceived and executed in-house. The payoff? Agility in storytelling, consistency in tone and cadence that external agencies would struggle to maintain.

As Mendiratta puts it, “Keeping your soul in-house keeps you more agile, more frequent and ultimately, more culturally aligned.”

The team structure is equally unconventional. The brand team is talent-dense, with all 40 members bringing strong creative chops, cultural alignment and other distinctive strengths needed to operate in cross-functional pods. Brainstorming is democratic (read an open-to-all exercise), teams are randomly formed and contributors are publicly acknowledged.

“Here, ideas flow freely as there are no bad ideas in brand marketing. Some ideas are good and others take you to good ideas,” said Mendiratta.

The entire setup is designed for speed and continuity. Agility is not an option in an industry where campaigns sometimes need to be conceived, produced and launched within hours. Speed has to be baked into the company’s operating system; it is a foundational design principle, believes Mendiratta.

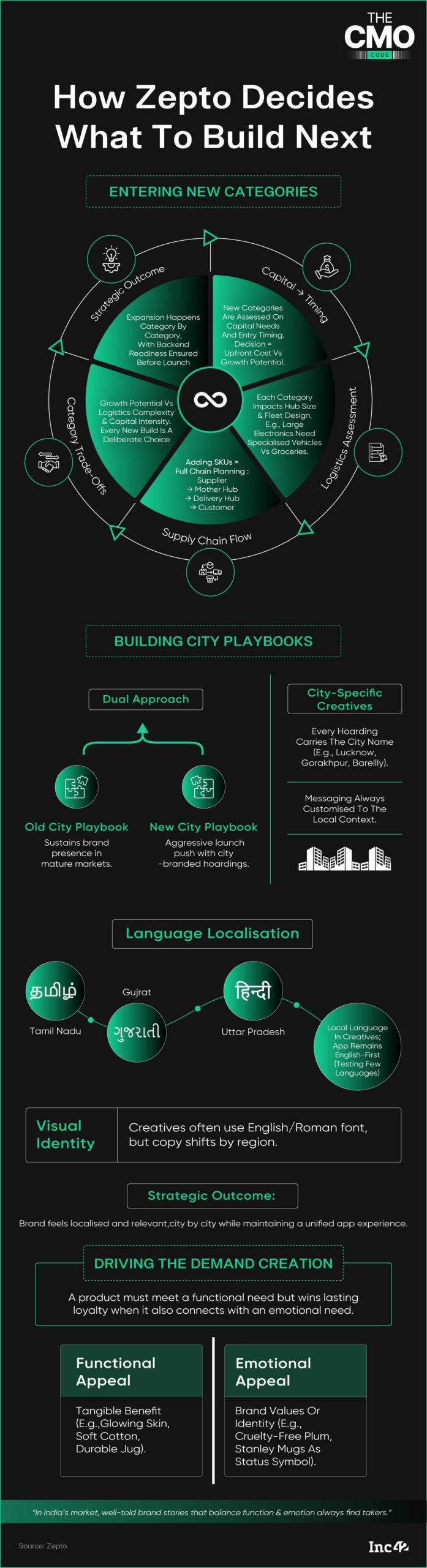

At Zepto, adding a new category is never a simple merchandising move or a matter of stocking shelves. It is often considered a capital-intensive operational puzzle, and for good reasons. Each new category or SKU has ripple effects across logistics, delivery hubs, fleet types and supply chains.

For instance, launching large electronics would mean rethinking the last-mile fleet, hub sizing, packaging protocols and shipping workflows. Also, every leg of the logistics journey — from the supplier to the mother hub, from there to local delivery hubs and finally to the customer — must be evaluated and fine-tuned. The decision matrix will include growth estimates, capital investment and backend complexity.

“Building a new category is not limited to stocking inventory. It is also about the logistics behind it. Each decision comes down to investment versus expected returns,” said Mendiratta, underscoring the capital-versus-growth trade-offs that define a new launch.

The same rigour applies to marketing. Zepto has adopted a two-track playbook to expand into new markets. It uses a tried-and-tested brand strategy for mature cities and rolls out a high-visibility launch blitz in up-and-coming cities. Whether it is launching in Lucknow, Gorakhpur, or Bareilly, there will be hyperlocal campaigns, city-specific billboards, regional messaging and tailored welcome kits to seed trust quickly.

Language plays a key role in this localisation push. While its main app primarily uses English, Zepto experiments with vernacular creatives, often written in Roman script, to match the linguistic identity of each state. These initiatives bridge the gap between first exposure and brand adoption in markets where brand recall is still nascent.

However, market creation goes beyond tweaking city playbooks and launching new categories. It is about uncovering latent demand. Consumer demand is never absent in a rapidly evolving, aspirational economy like India. It has not been activated yet.

“With rising incomes and evolving consumer taste, people are ready to buy into functional and emotional stories, if these are told well,” observed Mendiratta.

He distinguishes the rational and the emotional hooks that drive sales. The functional appeal — skin glow, fabric comfort, or product durability — must always be there. But the emotional layer often tips the scale. His daughter, for instance, uses a specific skincare brand not for its superior results but for its cruelty-free strategy.

Or take the Stanley jug, designed initially for American truckers. In India, its pull is less about utility than what it signals: Aspiration, lifestyle, status. That is the marketer’s brief, says Mendiratta. It is about finding and amplifying an emotional chord. A good story, built on functional value and emotional pull, can spark demand where none existed earlier.

For Zepto, the ‘10-minute delivery’ promise has shifted from a bold marketing pitch to a baseline expectation. As the quick-commerce startup advances along its growth curve, the next phase will hinge on deepening its focus on daily-consumption categories and pushing into segments that rivals have yet to crack.

Again, delivering on the 10-minute promise remains more complex than it appears. Zepto may have refined its logistics and tech stack to make it routine, but delivery timelines still depend on location, hub density and operational scale. Although many customers receive their orders within 10-12 minutes, shrinking that window further to sustain its competitive edge may not be feasible.

Zepto is moving aggressively, though. Close to 1K delivery hubs already dot its service cities, with the density set to rise in the years ahead. The startup aims to deliver 90% of its orders within 10 minutes across every pin code it serves. But hitting that target will require further densifying the network and recalibrating city-by-city operations.

Driving this speed is a high-stakes race to dominate existing and emerging verticals. While groceries remain the volume driver, the next phase of quick commerce success will hinge on how platforms like Zepto foray into high-margin verticals like fashion, electronics, footwear and pharmacy. These are largely untapped segments, but each brings distinct backend complexities and delivery protocols.

Understandably, the challenge is not limited to expanding SKU counts, but to building a backend that can adapt to the demands of vastly different products. It will be a capital-intensive play that may eventually force the q-commerce startup to broaden its scope and evolve into a full-spectrum retail platform.

For Zepto, the branding challenge is twofold — scaling fast while retaining the emotional resonance. Its marketing strategy is also shifting from pure performance play to deeper brand affinity for greater impact. However, the company may not loosen its purse strings to support this shift.

Currently, the focus is on acquiring top-of-the-funnel users, boosting order frequency and reactivating dormant customers. This means flagship campaigns like Super Saver must position Zepto as the fastest provider and an affordable option.

In essence, the path forward for the brand team is not without uncertainties. Mendiratta has learnt that processes and performance metrics are vital, but the heart of brand marketing lies in creative ideas.

“Every great campaign leaves you wondering if you can ever top it. That anxiety never fully goes away,” he reflected.

For him, the most difficult part of the job is navigating the ambiguity that comes with ideation. There’s no formula, no consistent trigger. Ideas often surface unprompted while driving, during casual conversations, or in quiet moments. And there is always the risk that the next big one may not come. Still, this unpredictability is what separates brand-led growth from formulaic execution.

“The role of a modern marketer extends beyond measuring impact. It is about creating meaning to serve the business and the people it seeks to reach,” he added.

The next phase will decide whether Zepto can scale its promise without losing the magic. Now that it has fired on all cylinders, the brand’s growth engine must move with logistics, product expansion and user expectations. If the past few years were about making 10-minute delivery a reality, the next few will see whether it becomes an indispensable layer of India’s retail stack.

Edited by Sanghamitra Mandal

The post How Zepto’s Brand Engine Keeps Its 10-Minute Promise Alive appeared first on Inc42 Media.

You may also like

Sombre Kate Middleton arrives to pay respects at the Duchess of Kent's funeral

Robert Redford's iconic last appearance as he came out of retirement months before death

Man stumbles upon Manchester United shirt in charity shop and is floored by cost

Bangladesh vs Afghanistan T20 Pitch Report: How will the conditions play for the Asia Cup clash?

Bengal BJP plans week-long programmes from tomorrow to celebrate PM Modi's 75th birthday